Does Home Insurance Cover Flooded Basement? Essential Aspects to Know

Owning a home comes with its fair share of responsibilities, and protecting your investment with home insurance is crucial. However, many homeowners often overlook the importance of understanding what their policy covers and excludes. One area that can raise confusion is whether home insurance covers flooded basements.

To shed light on this topic, let's delve into the essential aspects of home insurance coverage for flooded basements and provide valuable information to help you make informed decisions.

Understanding Standard Home Insurance Coverage

Typically, standard home insurance policies do not cover flood damage, including water damage to your basement caused by flooding. This is because flooding is considered a separate peril that requires specific coverage.

Flood Insurance as a Separate Coverage

To protect your basement from flood-related damages, you need to purchase separate flood insurance. This type of coverage is typically offered by the National Flood Insurance Program (NFIP) through participating insurance companies. Flood insurance can safeguard your basement and its contents against damage caused by rising water, including groundwater, storm surge, and river overflow.

Exclusions and Limitations in Coverage

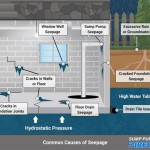

It's important to note that flood insurance may have certain exclusions and limitations. For example, it may not cover damages caused by water backing up from drains or sump pumps, or water seeping into your basement through cracks or foundation walls.

Factors Affecting Coverage Options

Availability and coverage options for flood insurance can vary depending on your location, the history of flooding in your area, and the elevation of your home relative to floodplains. These factors can influence the cost of flood insurance premiums.

Importance of Disclosure and Documentation

When purchasing flood insurance, it's crucial to disclose all relevant information about your property and any previous flood-related damages. Accurate documentation, such as photos or videos of flood damage, can help support your claim should the need arise.

Measures to Minimize Flood Risk

In addition to insurance coverage, taking proactive measures to minimize the risk of flooding in your basement can be beneficial. These steps may include:

- Installing a sump pump with a backup battery

- Sealing basement walls and floors

- Grading your property to direct water away from the foundation

Conclusion

Understanding your home insurance coverage for flooded basements is essential for homeowners. Standard home insurance policies generally do not cover flood damage, so it's important to purchase separate flood insurance to protect your investment. By being aware of the exclusions and limitations of flood insurance, you can make informed decisions about the coverage you need and take steps to minimize the risk of flooding in your basement.

Why Your Insurance Likely Won T Protect You If Basement Floods Cbc News

Does My Home Insurance Cover A Flooded Basement

Storm Damage Homeowners Insurance 5 Things You Need To Know Auto Owners

Flooded Basement Will My Insurance Cover Nytdr

Does Home Insurance Cover Water Damage

Does Homeowners Insurance Cover Water Damage Quicken Loans

Does Homeowners Insurance Cover Water Damage Money

Home Insurance Does It Cover Foundation Repairs Or Basement Flooding Acculevel

Does Homeowners Insurance Cover Foundation Repair Concrete Network

Solved Does Homeowners Insurance Cover Water Damage Bob Vila

See Also